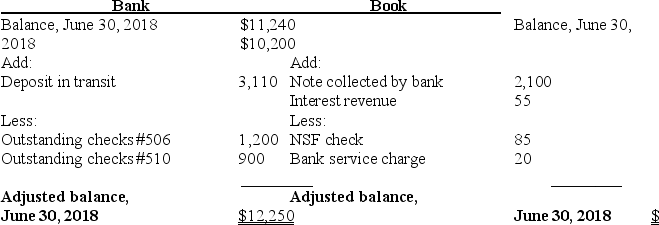

Refer to the following bank reconciliation:

Journalize the adjusting entry for the third reconciling item: NSF check.Omit explanation

Journalize the adjusting entry for the third reconciling item: NSF check.Omit explanation

Definitions:

Straight Debt

A fixed-income security, such as a bond, that has a predetermined interest rate, maturity, and principal repayment schedule.

Credit Default Swap

A specific type of credit derivative where the underlying reference asset is a credit obligation such as a bond or a bank loan of a specific company. One counterparty (the protection buyer) makes a periodic payment (the credit default swap premium) to the second counterparty (the protection seller). If the underlying reference asset suffers a credit event such as bankruptcy, the protection seller will make a payment to the protection buyer. Credit default swaps allow protection buyers to hedge themselves against credit risk, and protection sellers to invest based on their assessment of credit risk.

Premium Rate

This refers to the additional cost above the standard rate charged by financial instruments or insurance policies, to cover additional risks or benefits.

Warrants

Securities that grant the holder the right to purchase the issuer's stock at a specified price within a certain time frame.

Q8: The two common methods of processing credit

Q22: When replenishing the petty cash fund,the company

Q52: Which of the following items would require

Q80: An overstatement of ending merchandise inventory in

Q117: Boulevard Home Furnishings had the following balances

Q123: The entry to write off an account

Q146: A petty cash fund was established with

Q178: The entity that signs the promissory note

Q199: On January 1,Five Star Services has the

Q211: When businesses accept payment by credit and