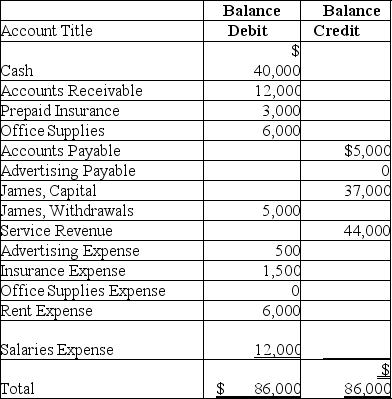

The unadjusted trial balance of James Business Consulting at December 31,2018,and the data for the adjustments follow:

James Business Consulting

Unadjusted Trial Balance

December 31,2018

Data for adjustments:

Data for adjustments:

a.James prepaid 6 months of business insurance on September 30,2018,with coverage beginning on October 1.James treats deferred expenses initially as assets.

b.A physical count of office supplies was made on December 31,2018.This count showed a balance of $4,200 office supplies on hand.

c.On December 31,2018,James received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is 1/10/2019.

James is preparing financial statements for the quarter ending December 31,2018.

Requirements

1.Journalize the adjusting entries on December 31,2018.

2.Prepare the December 31,2018 adjusted trial balance.Use a proper heading.

Definitions:

Subsidiary's Net Income

The amount of profit remaining after all expenses, including taxes and operating costs, have been subtracted from total revenue, specific to a company that is controlled by another entity.

Ending Balance

The amount of money in an account at the end of an accounting period, after all debits and credits have been accounted for.

Equity Method

An accounting technique used to record investments in associate companies where the investor has significant influence but not full control.

Excess Consideration

The amount paid over and above the fair value of net assets acquired in a business acquisition.

Q7: Athens Delivery Service is hired on October

Q45: The account title used for recording a

Q48: The process of transferring data from the

Q77: Which of the following is a source

Q98: In a vertical analysis of the income

Q111: Which of the following accounts would appear

Q134: A high times-interest-earned ratio indicates difficulty in

Q143: The cash ratio helps to determine a

Q143: To fill in the unadjusted trial balance

Q214: The following transactions have been journalized and