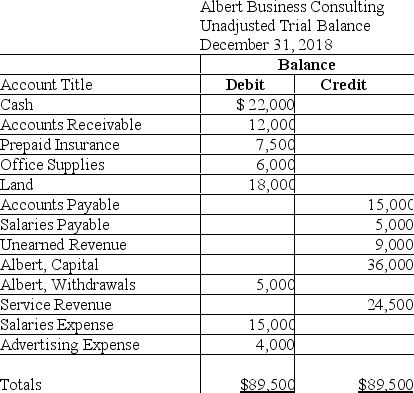

The unadjusted trial balance of Albert Business Consulting at December 31,2018,and the data for the adjustments follow:

Albert is preparing financial statements for the year ending December 31,2018.

Albert is preparing financial statements for the year ending December 31,2018.

Adjustment data at December 31 follows:

a.Albert pays its employees each Friday.December 31,2018 falls on a Monday.The employees will earn $1,250 for the five-day work week.

b.On August 31,2018,Albert agreed to provide consulting services to Smith Company for 6 months,beginning on September 1,2018,at $1,500 per month.Smith paid $9,000 on August 31,2018.Albert treats deferred revenues initially as liabilities.

c.Albert prepaid 6 months of business insurance on September 30,2018.The insurance begins on October 1.Albert treats deferred expenses initially as assets.

d.On December 31,2018,Albert received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is January 10,2019.

e.As of December 31,2018,Albert had performed services for Alliance Company for $5,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.Albert received the payment on its due date.

Requirement

1.Prepare the adjusting journal entries at December 31,2018.

2.Prepare the adjusted trial balance at December 31,2018.Include a proper heading.

Definitions:

Highest Level

The utmost degree or maximum extent of a particular quality, status, or achievement.

Situational Leadership Model

A flexible leadership method that proposes the need to adjust leadership style based on the maturity and competence level of followers.

Delegating Style

A management approach that involves assigning tasks and authority to subordinates, empowering them to make decisions and take action.

Responsibility

An obligation or duty to perform or complete a task, often with an accountability for the outcome.

Q10: The accounting process of transferring data from

Q17: Ottawa,Inc.provides the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6701/.jpg" alt="Ottawa,Inc.provides

Q31: The sum of all the depreciation expenses

Q50: Generally Accepted Accounting Principles (GAAP)require the use

Q87: Which of the following statements is TRUE

Q103: To accurately determine the financial performance of

Q104: Salaries are $4,000 per week for five

Q148: On the first day of January,Builders Company

Q194: Provide a definition of each of the

Q196: Adjusting entries are completed to ensure that