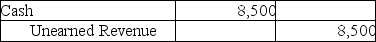

Adams Company recorded the following journal entry on March 2,2018.  From the journal entry above,identify the transaction on March 2,2018.

From the journal entry above,identify the transaction on March 2,2018.

Definitions:

Annual Lease Payment

The total amount of money required to be paid each year under the terms of a lease agreement.

Direct Financing Lease

A type of lease where the lessor effectively finances the leased asset, and the lease payments are structured to cover the original cost plus a profit margin.

Sales-Type Lease

A lease agreement where the lessor earns interest income over the lease term, treating the transaction like a sale.

Dealer Profit

The margin or financial gain a dealer achieves from the buying and selling of products or securities.

Q30: Identify how each of the following items

Q57: The balance sheet section of the worksheet

Q90: The three sections of the statement of

Q96: A chart of accounts provides more detail

Q120: After posting the journal entries from the

Q127: Which of the following will be classified

Q135: Which of the following describes working capital?<br>A)Current

Q142: An asset account is increased by a

Q153: Which of the following is NOT a

Q182: List and discuss three ways in which