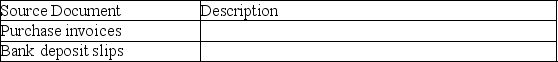

Briefly describe each of the following source documents:

Definitions:

Adjusted Basis

The original cost of a property adjusted for factors such as depreciation or improvements, used in calculating capital gains or losses for tax purposes.

Wash Sale

A tax term referring to the sale of a security at a loss and the repurchase of the same, or substantially the same, security shortly before or after, which disallows the claim of the loss for tax purposes.

Substantially Identical

Refers to property or securities that are nearly the same, often used in tax rules concerning wash sales.

Fair Market Value

The price at which an asset would sell on the open market between a willing buyer and a willing seller.

Q2: Which of the following statements is TRUE

Q7: National,Inc.provides the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6701/.jpg" alt="National,Inc.provides

Q23: Answer the following questions regarding the current

Q42: Which of the following statements,regarding the management's

Q82: The accounting period used for the annual

Q109: Use the following information to calculate the

Q111: Which of the following accounts would appear

Q129: Data for Sherwood,Inc.for the years ended December

Q157: To make sure that an error was

Q171: Which of the following is a permanent