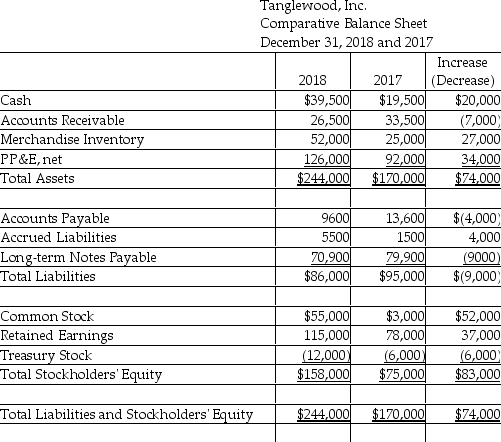

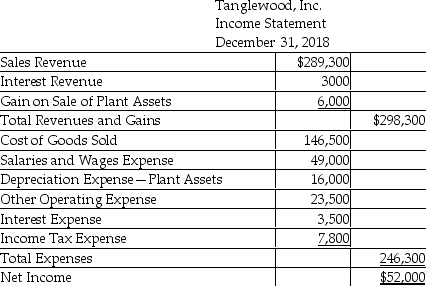

Tanglewood,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2018:

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense. )

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense. )

Definitions:

Current Liabilities

Current liabilities are a company's debts or obligations that are due to be paid to creditors within one year.

Temporary Investments

Securities or assets that a company intends to sell within a short period, typically one year, to generate income.

Net Receivables

The amount of money expected to be received from all outstanding accounts receivable after deducting allowances for doubtful accounts.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year, calculated as current assets divided by current liabilities.

Q16: Trinity Coatings Company uses the indirect method

Q47: Which of the following accounting methods is

Q56: When preparing the statement of cash flows,the

Q77: An accounts receivable turnover that is too

Q97: The amortization of bond premium increases interest

Q109: The following are selected current month's balances

Q126: The following transactions for the month of

Q126: Horizontal analysis is the study of percentage

Q151: What is the only difference between present

Q177: On January 1,2019,Commercial Equipment Sales issued $28,000