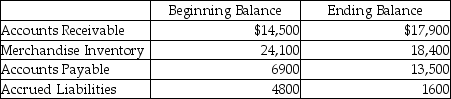

Designer Paints Company uses the direct method for preparing its statement of cash flow.Designer Paints reports the following information regarding 2018: From the income statement:

Sales Revenues,$267,000

Cost of Goods Sold,$213,000

Operating Expenses,$33,000

From the balance sheet: What amount will be shown for payments to suppliers for Merchandise Inventory purchases? (Assume that Accounts Payable are for purchases of merchandise inventory only. )

What amount will be shown for payments to suppliers for Merchandise Inventory purchases? (Assume that Accounts Payable are for purchases of merchandise inventory only. )

Definitions:

Activity-Based Costing

An accounting method that apportions overhead and incidental costs to the respective products and services based on the specific activities involved.

Worker Recreational Facilities

Facilities provided by employers for employees' relaxation and leisure, aiming to improve morale and productivity.

Facility-Level

Pertaining to costs and activities that are necessary for maintaining the overall operation of a plant or company, but not directly tied to individual products.

Underapplied Overhead

Represents the situation when the allocated factory overhead costs are less than the actual factory overhead costs incurred.

Q25: Diamond Corp.has provided the following information for

Q64: Van Jones is the owner of a

Q87: Which of the following accounts increases with

Q92: The time value of money is used

Q133: The direct method restates the income statement

Q141: Montgomery Corporation has excess cash to invest

Q161: Which of the following is TRUE of

Q183: Wisconsin Farm Equipment Company sold equipment for

Q202: Calculate the debt ratio using the following

Q217: Which one of the following account groups