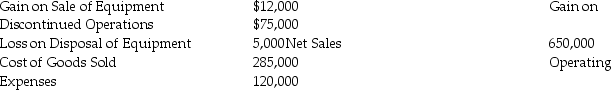

Nathan Corporation's accounting records include the following items for the year ending December 31,2018:

The income tax rate for the company is 45%.The company had 15,000 shares of common stock outstanding during 2018 and no preferred stock.Prepare Nathan's income statement for the year ending December 31,2018.Show how Nathan reports EPS data on its 2018 income statement.

The income tax rate for the company is 45%.The company had 15,000 shares of common stock outstanding during 2018 and no preferred stock.Prepare Nathan's income statement for the year ending December 31,2018.Show how Nathan reports EPS data on its 2018 income statement.

Definitions:

Direct Discrimination

Unfair treatment of individuals based on their specific characteristics, such as race, gender, or age, as directly expressed by actions or policies.

Indirect Discrimination

practices or policies that appear neutral but result in unfair treatment of certain groups without direct intention to discriminate.

Robinson-Patman Act

Part of a group of laws collectively called the antitrust laws governing competition in the United States. Under the Robinson–Patman Act, it’s illegal to give or receive a price discount on a good sold to another business. This law does not cover services and sales to final consumers.

Price Discrimination

The strategy of selling the same product to different customers at different prices, often based on their willingness or ability to pay.

Q16: Which of the following is TRUE when

Q33: The account Paid-In Capital from Treasury Stock

Q34: Which of the following is TRUE of

Q49: Solutions Services sells service plans for commercial

Q52: On January 1,2019,Drake Services issued $20,000 of

Q69: A stock split can involve issuing more

Q72: Scotland Corporation had net income for 2018

Q103: Tim's gross pay for this month is

Q146: FICA tax is a tax that is

Q148: Unrealized gains or losses on available-for-sale debt