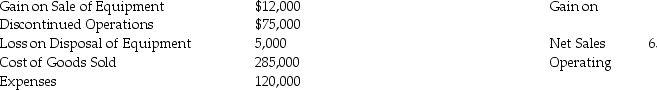

Adams Corporation's accounting records include the following items for the year ending December 31,2019:

The income tax rate for the company is 25%.Prepare Adams' multi-step income statement for the year ended December 31,2019.Omit earnings per share.

The income tax rate for the company is 25%.Prepare Adams' multi-step income statement for the year ended December 31,2019.Omit earnings per share.

Definitions:

Disinhibition

The reduction or removal of inhibition, resulting in an increase in previously suppressed behaviors or actions.

Sensitization

An increased response to a stimulus following repeated exposure, usually associated with adverse or noxious stimuli.

Habituation

A learning process where an organism reduces its responsiveness to a non-threatening stimulus over time through repeated encounters.

Stimuli

External or internal events that elicit a response from an organism.

Q33: The account Paid-In Capital from Treasury Stock

Q56: Which of the following requires a formal

Q75: On January 1,2018,Global Sales issued $25,000 in

Q84: When a partner withdraws his or her

Q86: A business that has a vacant building

Q104: The times-interest-earned ratio is calculated as EBIT

Q122: The rate of return on total assets

Q185: Stock dividends are declared by the _.<br>A)chief

Q208: The statement of stockholders' equity reports the

Q270: A corporation's income statement includes some unique