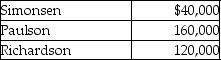

Simonsen,Paulson,and Richardson are partners in a firm with the following capital account balances:  The profit-and-loss-sharing ratio among Simonsen,Paulson,and Richardson is 1:3:2,in the order given.Paulson is retiring from the partnership on December 31,2017.Paulson is paid $230,000 cash in full compensation for her capital account balance.Which of the following is TRUE of the journal entry prepared at the time of retirement? (Round the final answer to the nearest dollar. )

The profit-and-loss-sharing ratio among Simonsen,Paulson,and Richardson is 1:3:2,in the order given.Paulson is retiring from the partnership on December 31,2017.Paulson is paid $230,000 cash in full compensation for her capital account balance.Which of the following is TRUE of the journal entry prepared at the time of retirement? (Round the final answer to the nearest dollar. )

Definitions:

Canada's Land Area

The total surface area occupied by Canada, making it the second-largest country in the world by land area.

Graduated Commission

A graduated commission is a payment structure for sales personnel where the commission rate increases as the salesperson achieves higher sales thresholds.

Gross Earnings

The total income earned by an individual or company before any deductions or taxes.

Convention Centre

A large facility designed to host conferences, meetings, exhibitions, and other events.

Q44: Which of the following is TRUE of

Q75: On January 1,2018,Global Sales issued $25,000 in

Q146: FICA tax is a tax that is

Q149: FICA tax is paid by the employee

Q159: Keith and Jim are partners.Keith has a

Q181: Exchanges of plant assets that have commercial

Q185: Stock dividends are declared by the _.<br>A)chief

Q233: Certified Management Accountant<br>A)Specializes in accounting and financial

Q266: Which of the following types of stock

Q272: Which of the following is TRUE of