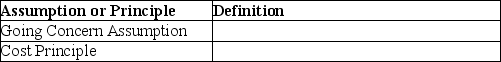

Provide the definition of each of the following accounting assumptions or principles.

Definitions:

Federal Income Tax

A tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction.

Corporate Form

A legal structure for a business recognized as a separate legal entity from its owners, providing limited liability but facing double taxation.

Treasury Stock

Treasury stock consists of shares that were once part of the outstanding stock of a company but were later purchased back by the company from shareholders. These shares do not confer voting rights and do not pay dividends.

Q12: Which statement suggests that an absolute measure

Q14: Imagine a world in which there is

Q18: According to the lock-in effect,individuals may:<br>A) sell

Q22: A journal entry is prepared to reclassify

Q25: Which is considered to be a tax

Q32: Ordinary repairs to plant assets are referred

Q35: Which of the following is a fundamental

Q89: On January 1,2019,a company acquired a truck

Q138: List the four financial statements and describe

Q192: A payroll register is a schedule that