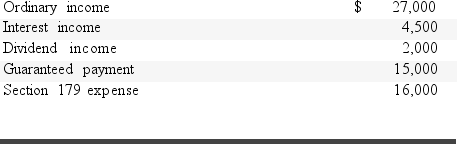

A partner had the following items reported on a partnership Schedule K-1:  The partner's self-employment income for the year is:

The partner's self-employment income for the year is:

Definitions:

Cash Customer

A customer who pays for goods or services with cash at the time of purchase rather than buying on credit.

General Journal

A primary accounting record used to record all types of transactions before they are transferred to specific accounts in the general ledger.

Sales Tax

A government-imposed tax on the sale of goods and services, collected by the retailer and passed on to the government.

General Journal

A primary accounting record used to record all types of transactions before they are posted to the specific accounts in the ledger.

Q18: Which statement most closely reflects the philosophy

Q24: Which of the following themes would clients

Q28: The child tax credit is reduced if

Q35: Valarie owns 100% of Green Company.Green has

Q57: Choice theory is based on the assumption

Q59: The passive activity loss rules require income/loss

Q89: A pension or profit-sharing plan must not

Q94: Claude works as a teacher during the

Q112: All taxpayers must file Form 1116 to

Q120: Marci has two jobs and both employers