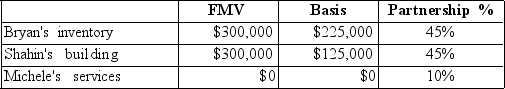

Bryan,Shahin,and Michele form a partnership.Bryan and Shahin contribute inventory and a building,respectively.Michele agrees to perform all of the accounting and office work in exchange for a 10% interest.

a.Do any of the partners recognize any gain? If so,how much and why?

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership of each asset?

Definitions:

Microsoft Excel

A spreadsheet application developed by Microsoft, which allows users to create, manipulate, and analyze data through tables, formulas, and charts.

Linking

The process of creating connections between various pieces of data, documents, or programs to facilitate easy access to related information.

Importing

The process of bringing data from an external source into a software application or system.

External File

A file stored outside of the current working document or database, which can be accessed or imported into the document.

Q28: The child tax credit is reduced if

Q35: The technique of reliving and reexperiencing unfinished

Q40: Kyle and Alyssa paid $1,000 and $2,000

Q41: A limitation of person-centered therapy is:<br>A)the possible

Q43: Chun Hei is a Korean immigrant who

Q59: Feminist therapy is a technically integrative approach

Q62: The sale of a partnership interest is

Q69: Jasmine sold land for $250,000 in 2016.The

Q75: An involuntary conversion results in money received.If

Q92: A qualifying individual for the purposes of