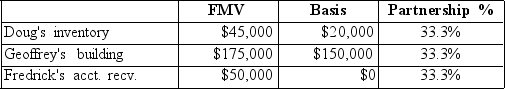

Doug,Geoffrey,and Fredrick form a partnership and contribute the following assets:

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership in each asset?

d.What are the holding periods to the partnership for each asset?

e.How would your answer change with respect to Geoffrey if his basis in the building was

$85,000?

Definitions:

Closed-end Funds

Investment funds with a fixed number of shares, traded on stock exchanges, potentially at prices above or below their net asset values.

Open-end Funds

Mutual funds that continuously issue new shares to investors and buy back shares when investors wish to sell, with prices determined by the net asset value.

Equity Funds

Mutual funds or other types of investment funds that invest primarily in stocks, seeking to provide returns through equity ownership.

Mutual Fund Assets

The total market value of all the financial assets being managed by a mutual fund.

Q13: Puri is a self-employed Spanish teacher.Her earnings

Q25: The AMT tax rate for individuals is

Q52: The receipt of boot in a like-kind

Q66: In Whitaker's experiential therapy,there is a greater

Q66: Which of the following items decrease basis

Q70: Which of the following statements is incorrect?<br>A)Some

Q80: Taxpayers with household income between 100% and

Q98: Employers with a payroll tax liability of

Q106: Griffith & Associates is trying to determine

Q106: Initially,corporations with average annual gross receipts for