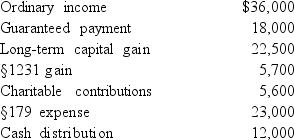

Rita has a beginning basis in a partnership of $43,000.Rita's share of income and expense from the partnership consists of the following amounts:

a.What items are separately stated?

a.What items are separately stated?

b.What is Rita's self-employment income?

c.Calculate Rita's partnership basis at the end of the year.

Definitions:

Government Provision

The act of supplying or making available goods, services, or benefits to the public by the government, often and typically funded through taxpayer money.

Government Production

The production of goods and services by government entities, often aimed at providing public goods that are not sufficiently supplied by the private sector.

Nonprofit Organization

An entity operating for purposes other than generating profit, typically focused on social, educational, or charitable activities.

Revenue Received

Income that an organization receives from its normal business operations, usually from the sale of goods and services to customers.

Q11: Alabaster Company is a Subchapter S corporation.It

Q12: There are four characteristics that a C

Q12: The relational-cultural theory emphasizes the vital role:<br>A)that

Q14: STU Corporation has taxable income before DRD

Q19: There is no difference between regular tax

Q37: Jose purchased a 30% partnership interest for

Q40: Jean-Pierre told the family therapist that his

Q89: When a corporation is formed,if the sole

Q100: Distributions from a retirement plan are not

Q116: Which of the following statements is incorrect?<br>A)A