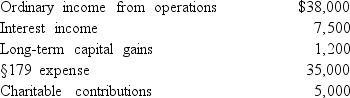

Marty and Blake are equal partners in MB Partnership.The partnership reports the following items of income and expense:

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

b.Where on what forms)will these amounts be reported by the partners?

Definitions:

Q24: A counselor using an integrative approach to

Q26: Which of the following therapists would accept

Q34: If a taxpayer works for two separate

Q39: Which of the following approaches places emphasis

Q41: Upon the sale of a partnership interest,a

Q64: On April 30 of the current year,Ashley

Q80: Taxpayers with household income between 100% and

Q102: The main goal of Congress in offering

Q111: Although the federal unemployment tax is 6.0%

Q129: The maximum lifetime learning credit per taxpayer