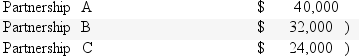

Alice is an attorney and earned $175,000 from her practice in the current year.Alice also owns three passive activities.The activities had the following income and losses:  What is Alice's adjusted gross income for the current year?

What is Alice's adjusted gross income for the current year?

Definitions:

Custodial Fathers

Fathers who have been granted primary legal and/or physical custody of their child by a court following a separation or divorce.

Rescue Fantasy

A psychological pattern where an individual harbors a desire to rescue others, often rooted in a need to feel valued or to avoid one's own problems.

Stepchild

A child of one’s spouse by a previous partner, who one does not biologically parent but may fulfill a parental role for.

Adult Children

Adults who are the offspring of their parents, often considered in the context of their relationship with their parents or their roles within a family.

Q4: Partnership income and losses are divided into

Q13: The feminist perspectives on the development of

Q23: Catherine purchased furniture and fixtures 7-year property)for

Q27: Schedule M-1 reconciles from taxable income to

Q31: In solution-focused therapy,behavior change is viewed as

Q40: Benjamin and Ester file a joint return

Q45: When a taxpayer is released from a

Q55: If a partner contributes services on the

Q70: A dealer of equipment can recognize gains

Q83: Which of the following statements is incorrect