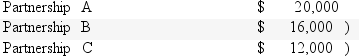

Spencer has an ownership interest in three passive activities.In the current tax year,the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

Definitions:

Operating Expense

Refers to the costs associated with the day-to-day operations of a business, excluding costs related to production.

Receivables

Amounts due to be paid to a company by its customers for goods or services delivered on credit terms.

Bad Debt Expense

The expense recognized when a business determines that an amount owed by a debtor is unlikely to be collected.

Specific Customer's Account

An account representing the transactions and outstanding balance related to a particular customer.

Q7: In 2013,the first year of its existence,Chartreuse

Q13: The feminist perspectives on the development of

Q19: There is no maximum amount for the

Q28: Keisha owns 100% of DEF Company and

Q40: A corporation has taxable income of $400,000.What

Q41: A limit of the feminist approach from

Q49: In working with a triangulated relationship,Bowen would

Q49: If a corporation has a net capital

Q58: Which of the following statements about strategic

Q69: Bowen's multigenerational approach stresses techniques more than