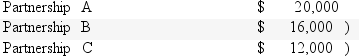

Spencer has an ownership interest in three passive activities.In the current tax year,the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

Definitions:

Opiate Receptors

Specialized protein structures located in the brain, spinal cord, and digestive tract that interact with opioid substances to produce pain relief, pleasure, and other effects.

Glutamate

An important neurotransmitter in the brain involved in learning, memory, and the regulation of the nervous system's activity.

Neuron's Reaction

The process by which a neuron responds to stimuli, often involving electrical and chemical signals to transmit information.

Axon Branches

Extensions of an axon, which are part of a neuron, that help in transmitting neural signals to other cells.

Q25: If a tenant pays an expense normally

Q26: Which of the following therapists would accept

Q31: How does a partner treat premiums on

Q59: Feminist therapy is a technically integrative approach

Q59: A Subchapter S corporation must be a

Q61: Bubba earned a total of $221,100 for

Q65: A taxpayer had AGI of $300,000 in

Q82: A taxpayer with an AGI of $157,350

Q84: A corporation has a fiscal-year end of

Q88: A C corporation can become a Subchapter