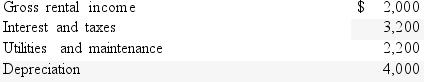

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% based on the IRS method) .They had the following income and expenses for the year before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

Definitions:

Q4: A stock dividend in which a shareholder

Q15: Molly is single with AGI of $22,500.During

Q26: In 2016,the maximum annual contribution to a

Q26: For 2016,the amount of the student loan

Q30: Shanstella bought a 4-unit apartment building in

Q47: Which of the following statements is incorrect?<br>A)To

Q49: Which of the following costs are deductible

Q64: Banks and credit unions report interest income

Q114: Qualified education expenses for the purpose of

Q119: An employer with 250 or more employees