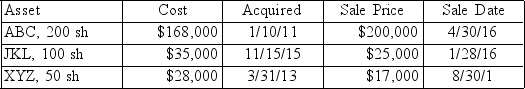

Stephanie sold the following stock in 2016.She received a 1099-B from each of the companies to record the sale.

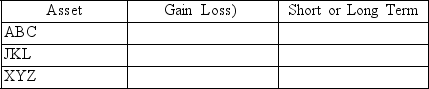

a.Complete the following table:

a.Complete the following table:

b.Calculate the short-term gain loss)after netting.

b.Calculate the short-term gain loss)after netting.

c.Calculate the long-term gain loss)after netting.

d.What is the resulting gain loss)to be shown on the return?

Definitions:

Q1: What are four major categories of deductible

Q28: A married couple in the process of

Q46: Household workers are subject to FUTA tax

Q47: Capital improvements on rental properties may be

Q55: Bob and Joyce are married,file a joint

Q57: Cynthia lives in California,a state that imposes

Q87: Glenn sells a piece of equipment used

Q93: Carl is 60 years old.On January 1,2016,Carl

Q113: Sade,who is single and self-employed as a

Q113: Brad and Kate received $9,500 for rent