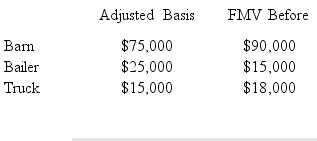

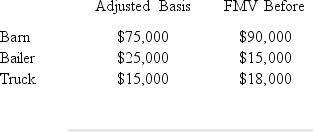

Alan owns a ranch in Kansas.During the year,a tornado damaged one of his barns and destroyed some equipment.The following information provides the details of the losses Alan suffered from the tornado.

FMV

After

After

Insurance Proceeds

$ 40,000 $30,000

$ 0 $15,000

$ 0 $10,000

How much loss from the tornado can he deduct on his tax return for the current year?

Definitions:

Common Shares

Equity securities that represent ownership in a corporation, with voting rights and the potential for dividends.

FIFO

Stands for "First In, First Out," an accounting method for valuing inventory and determining cost of goods sold, where the oldest inventory is sold first.

LIFO

Last In, First Out, an inventory valuation method where the most recently produced or acquired items are recorded as sold first.

Inflation

How fast the general price for goods and services climbs, lessening the power to purchase.

Q6: An individual must complete Schedule B Forms

Q18: Alexis's cabin in the mountains that was

Q18: What is the proper treatment for prescription

Q33: The for AGI deduction for the self-employment

Q59: There is an employment test,a distance test,and

Q62: The maximum penalty imposed on employers for

Q87: The exclusion for dependent care assistance plans

Q88: Tuition,fees,books,supplies,room,board,and other necessary expenses of attendance are

Q103: For a taxpayer to be eligible to

Q116: During 2016,Manuel and Gloria,who are married,incurred acquisition