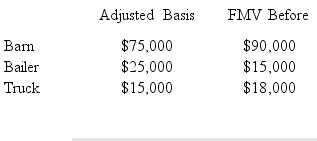

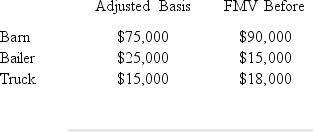

Alan owns a ranch in Kansas.During the year,a tornado damaged one of his barns and destroyed some equipment.The following information provides the details of the losses Alan suffered from the tornado.

FMV

After

After

Insurance Proceeds

$ 40,000 $30,000

$ 0 $15,000

$ 0 $10,000

How much loss from the tornado can he deduct on his tax return for the current year?

Definitions:

Social Structure

The organized pattern of social relationships and social institutions that together compose society, determining the behavior of individuals and groups.

Psychosocial Factors

Elements that influence an individual's psychological development and social interactions.

Chronic Stress

A consistent sense of feeling pressured and overwhelmed over a long period of time, which can lead to significant health problems.

Junk Food

Food that is high in calories but low in nutritional value, often characterized by high levels of sugar, fat, and salt.

Q1: The cost of holiday turkeys distributed to

Q14: Meredith has a vacation rental house in

Q39: The top tax rates for an individual

Q41: Gabriella,a single taxpayer,has wage income of $160,000.In

Q49: Which of the following costs are deductible

Q64: Rick and Claudia live in an apartment

Q99: The student loan interest deduction may be

Q100: In the case of personal/rental property,a taxpayer

Q120: Conner and Matsuko paid $1,000 and $2,000,in

Q132: The maximum child tax credit is $1,000