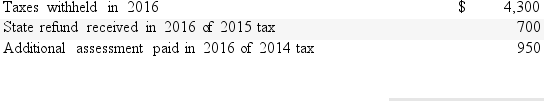

Shirin resides in a state that imposes a tax on income.The following information relates to Shirin's state income tax situation for 2016:  Assuming she elects to deduct state and local income taxes,what amount should Shirin use to calculate itemized deductions for her 2016 federal income tax return?

Assuming she elects to deduct state and local income taxes,what amount should Shirin use to calculate itemized deductions for her 2016 federal income tax return?

Definitions:

Illusory Promise

A statement that appears to be a promise but does not actually bind the party to any commitment or obligation.

Promissory Estoppel

A legal principle that prevents a party from going back on a promise, even if the promise was not formally agreed upon, if the other party has relied on that promise to their detriment.

Adequate Consideration

Sufficient value or compensation exchanged between parties in a contract, making the agreement legally binding.

Detriment

A state of being harmed or damaged, often used in legal contexts to describe loss or injury.

Q17: Are life insurance proceeds taxable to the

Q24: Patty and Rich,married filing jointly,have $385,000 in

Q37: Maria files her tax return married filing

Q41: Is the self-employed health insurance deduction available

Q62: Individual taxpayers may carry forward for five

Q75: Which of the following is a statutory

Q102: The basic standard deduction in 2016 for

Q105: DJ and Nicolette paid $1,600 in qualifying

Q106: Under a divorce agreement executed in 2016,periodic

Q115: Wyatt sold 300 shares of Clothes and