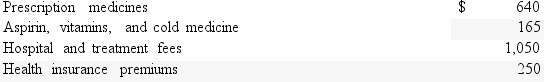

During 2016,Carlos paid the following expenses:  What is the total amount of medical expenses before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2016 income tax return?

What is the total amount of medical expenses before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2016 income tax return?

Definitions:

Sphygmomanometer

A device used to measure blood pressure, consisting of an inflatable cuff to restrict blood flow and a manometer to measure the pressure.

Mercury

A chemical element with the symbol Hg and atomic number 80, known for its use in thermometers, fluorescent lighting, and dental amalgams.

Aneroid

Refers to a type of barometer that measures air pressure without using liquid.

Dehydration

A condition resulting from excessive loss of body water, affecting bodily functions.

Q11: When royalty income is received,the recipient tax

Q39: The top tax rates for an individual

Q40: Which of the following is an example

Q47: A married couple can file a joint

Q51: Jena is a self-employed fitness trainer who

Q53: "Listed property" includes only passenger automobiles.

Q60: Delores,who is single,received her degree in 2016,and

Q78: One of the criteria to file a

Q92: A qualifying individual for the purposes of

Q116: The two methods that may be used