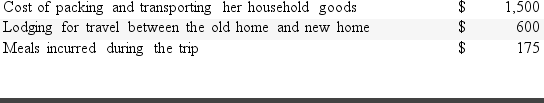

Rena had the following moving expenses during 2016:  Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2016 return?

Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2016 return?

Definitions:

Punishments

Consequences intended to reduce the likelihood of a behavior occurring again, usually seen as unpleasant or undesirable by the recipient.

Expertise

Specialized knowledge or skill in a particular area, acquired through training, study, or experience.

Price Ceiling

A legally established upper limit on the selling price of a product.

Equilibrium Price

The market price at which the quantity of a good demanded by consumers equals the quantity supplied by producers, leading to market stability.

Q16: Welfare payments received by a taxpayer must

Q17: A taxpayer is married with a qualifying

Q26: What is the tax liability for a

Q26: For 2016,the amount of the student loan

Q37: George is 21 years of age and

Q69: Madison is a teacher at a parochial

Q85: The tax liability for a married couple

Q89: To figure the gain or loss from

Q96: The initial original issue discount OID)on a

Q112: For tax purposes,one of the requirements to