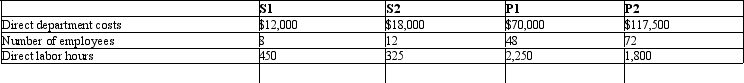

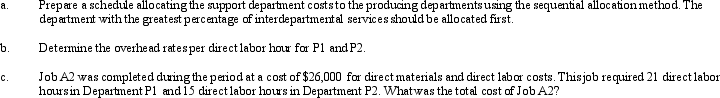

McDuff Company uses a job-order costing system to compute product costs. There are two producing departments (P1 and P2) and two support departments (S1 and S2). The costs incurred in S1 and S2 are allocated to Departments A and B and included in their factory overhead rates for costing products. S1 costs are allocated based on the number of employees, S2 costs are allocated based on direct labor hours, and the production departmental overhead rates are also based on direct labor hours. The following data are available for a recent period:

Required:

Required:

Definitions:

Adjusted Trial Balance

A list of all the accounts and their balances after adjustments are made for revenues and expenses, used to prepare financial statements.

Financial Statement Column

A column in a financial statement that categorizes financial data, such as assets, liabilities, revenues, or expenses, to help analyze financial health.

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances of temporary accounts to permanent accounts and prepare the accounts for the next period.

Owner's Equity Statement

A financial statement that shows the changes in the equity of a company's owner(s) over a period of time.

Q4: Homogeneous products refer to<br>A) products similar in

Q23: Which of the major objectives of allocation

Q24: Compare the relative effects of inhibiting your

Q42: Describe the differences between support and producing

Q53: Which is NOT a difference between the

Q60: The Awesome Systems Company, which uses direct

Q101: Activity _ helps management achieve objectives such

Q102: Participative budgeting has which of the following

Q105: Static budgets show costs for varying levels

Q153: The Tolstoy Corporation uses JIT manufacturing. There