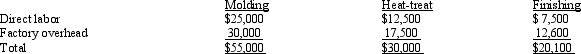

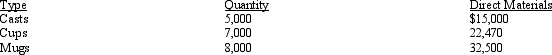

Figure 6-20 Outrageous Cups Corp. manufactures cups. The company's manufacturing operations and costs applied to products for April were: Three types of cups were produced in April. The quantities and direct materials costs were:

Three types of cups were produced in April. The quantities and direct materials costs were: Casts are produced in the Molding Department. Cups pass through the Molding and Finishing Departments. Mugs pass through all three departments. An operations costing system is used.

Casts are produced in the Molding Department. Cups pass through the Molding and Finishing Departments. Mugs pass through all three departments. An operations costing system is used.

Refer to Figure 6-20. What is Outrageous Cups' total cost per unit for Cups in April?

Definitions:

Marginal Tax Bracket

The tax rate that applies to the last dollar of the taxpayer's income, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Equivalent Taxable Yield

The pretax yield on a taxable bond providing an after-tax yield equal to the rate on a tax-exempt municipal bond.

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, including all interest payments and the return of principal.

Treasury Securities

Reiteration of U.S. Treasuries, but emphasizing these are safe, low-risk investment products backed by the full faith and credit of the U.S. government, including Treasury bonds, notes, and bills.

Q1: Restaurant Products produces two products, X and

Q28: _ is useful when the dependent variable

Q36: The effect of uniform production levels on

Q42: The cost assigned to goods from a

Q103: If a support department's costs were budgeted

Q113: Figure 5 - 8 Lamour Corporation is

Q121: A(n) _ is a grouping of logically

Q124: In an activity-based costing system activity cost

Q129: Common costs are mutually beneficial costs, used

Q184: The major benefit of the weighted average