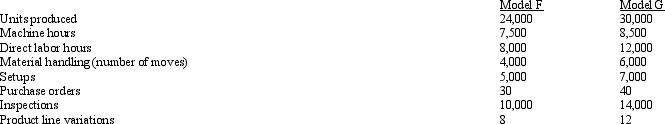

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

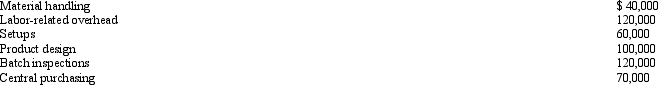

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

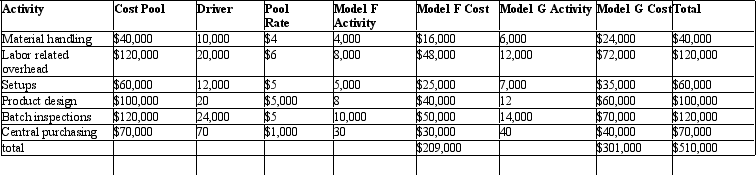

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what cost would be assigned to materials handling?

Definitions:

Counterproductive Use

Refers to actions or behaviors that negatively affect the intended outcome or overall productivity.

Legislative Votes

The process by which laws are proposed, debated, and decided upon within a legislative body.

Political Power

The ability of individuals or groups to influence or control the policies and actions of a government or organization.

Special Interest Groups

Organizations that represent the interests of a specific group of people or agenda, aiming to influence public policy and opinion.

Q7: Figure 4-11 Longview Manufacturing Company manufactures two

Q15: Figure 4-8 Tandem Company manufactures two products

Q60: If activity-based costing is used, insurance on

Q62: In the method of least squares, each

Q82: The Johnson Company is trying to find

Q102: In job-order costing, departmental overhead rates and

Q104: The accounting information subsystem that is primarily

Q110: Using the before-the-fact simplification method TDABC eliminates

Q126: Figure 4-7 The Cherokee Company uses a

Q182: The cumulative average-time learning curve model states