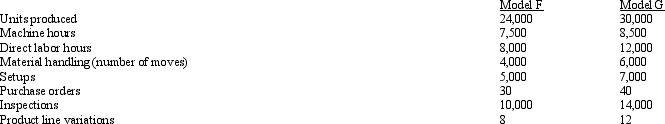

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

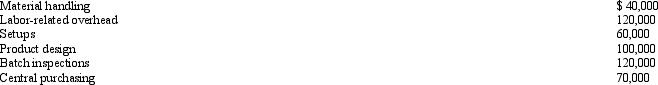

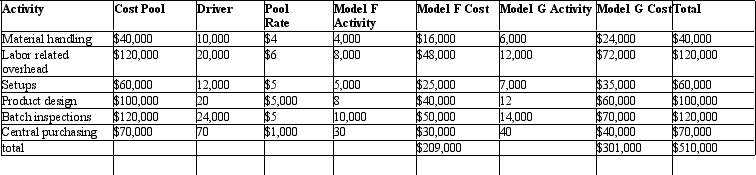

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what cost would be assigned to the labor related cost pool?

Definitions:

Financial Statements

Financial statements are formal records of the financial activities and condition of a business, including balance sheet, income statement, and cash flow statement.

Income Statements

Income statements are financial documents that provide a summary of a company's revenue, expenses, and profits over a specific period, typically quarterly or annually.

After-Tax Return

The profit realized on an investment after accounting for any taxes paid.

Federal and Provincial Tax Rates

The individual income tax rates imposed by the federal government and provincial governments in Canada, varying based on income level and location.

Q25: Stainless Steel Company has two production departments:

Q29: Inventive Manufacturing Company has the following activities:

Q48: Figure 6-5 Maynard Inc. manufactures desks. The

Q56: Stanfil Corporation developed a cost function for

Q126: The three widely used quantitative methods of

Q134: Gross margin is the difference between _

Q143: In a job-order costing system, actual overhead

Q144: If there is a debit balance in

Q178: In a traditional manufacturing company, product costs

Q185: Figure 4-16 Samson Company recently installed an