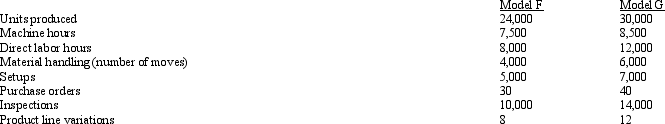

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

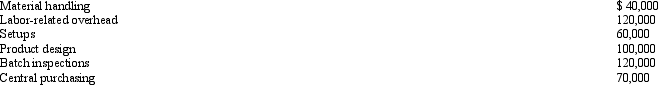

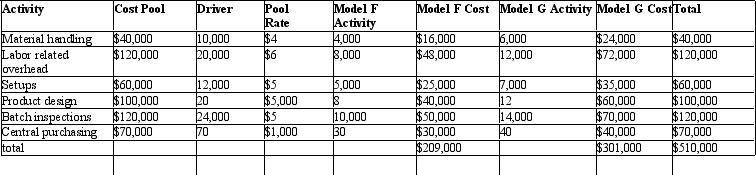

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach using the new rates, what are the overhead costs assigned to Model G in this approximately relevant ABC system?

Definitions:

Q28: When normal costing is used, actual overhead

Q49: Figure 5 - 3 Robinson Corporation constructs

Q58: Which of the following statements is TRUE

Q65: If a firm has implemented activity-based procedures

Q72: In process costing, _ costing can be

Q113: Sweet Tooth Company manufactures candy. The company

Q150: A company has purchased some steel to

Q156: Whenever least squares is used to fit

Q174: Which is NOT a characteristic of a

Q190: Green Mountain Manufacturing has recently installed an