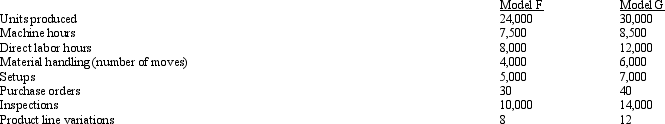

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

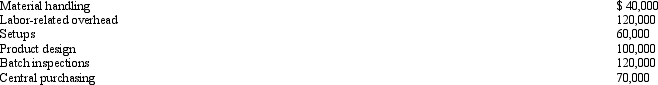

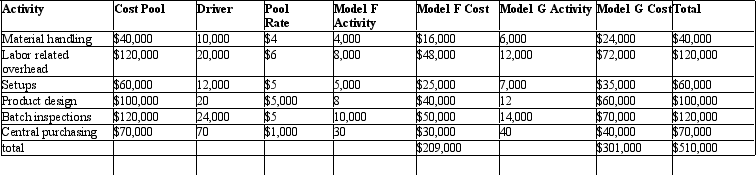

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, the overhead cost assigned to Model F would be? (round to 5 decimal places)

Definitions:

Working Capital

The gap between what a firm owns in the short term (assets) and what it owes (liabilities), revealing its efficiency in operations and financial stability in the near term.

Accounts Receivable Turnover

A financial ratio that measures how many times a business can collect its average accounts receivable during a period, indicating how efficiently it manages credit extended to customers.

Average Sale Period

The average time it takes for a company to complete a sales cycle from the initial contact to the final sale.

Average Sale Period

A financial metric that calculates the average time it takes for a company to sell its inventory, indicating the efficiency of sales and inventory management.

Q7: Figure 4-11 Longview Manufacturing Company manufactures two

Q67: Figure 4-12 The Gardenview Corporation has identified

Q89: Figure 2-11 Information from the records of

Q97: Figure 4-22 The Wellness Clinic is considering

Q115: Cost management information benefits production, marketing, and

Q124: Figure 6-21 Golden Ring Company produces two

Q135: The average activity that a firm experiences

Q160: Account balances from the Boilermakers Company are

Q170: Which of the following is NOT a

Q201: Which cost assignment method would likely assign