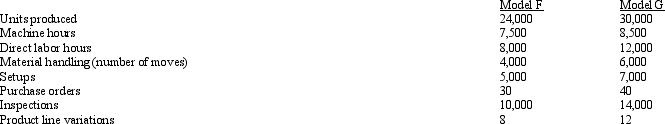

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

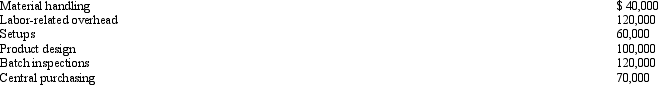

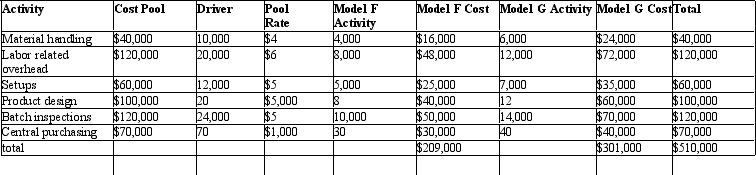

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, which two activities would be selected as the cost pools?

Definitions:

Pleasure

A feeling of happiness, enjoyment, or satisfaction derived from experiencing or doing something desirable.

Insulation Job

The installation of insulating materials in buildings or structures to reduce the transfer of heat and enhance energy efficiency.

Annual Fuel Bill

The total cost incurred by an entity or an individual for fuel consumption over the course of a year.

Interest Rate

The charge, presented as a percentage of the principal, required by a lender from a borrower for the employment of assets.

Q10: The costs of holding inventory are called

Q11: Based on managerial judgement, the best predictor

Q18: If the total warehousing cost for the

Q46: The _ parameter is the point at

Q51: Which of the following products would NOT

Q59: Weaknesses of the high-low method include all

Q97: With multiple internal binding constraints, the optimal

Q104: FIFO follows the job-order costing principle.

Q122: Which of the following is NOT an

Q180: The scatterplot method of cost estimation<br>A) is