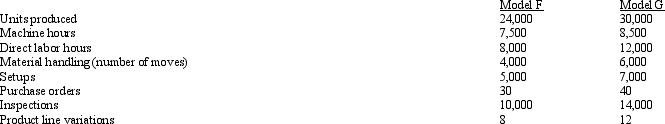

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

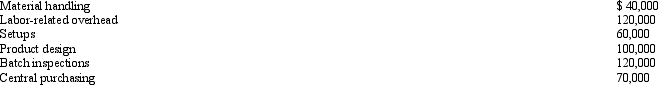

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

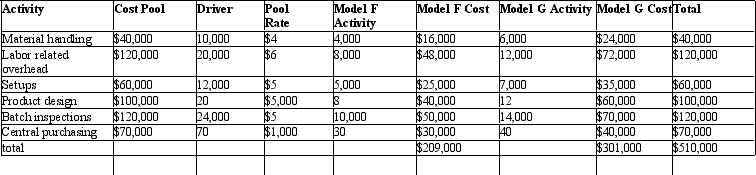

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach using the new rates, what labor cost is assigned to Model F in this approximately relevant ABC system?

Definitions:

Total Revenue

The total income generated by a company from its business activities, often from the sale of goods and services, before any expenses are subtracted.

Net Book Value

The value of an asset after accounting for depreciation and amortization, as recorded on a company's balance sheet.

Invested Capital

Funds invested by shareholders and debt holders in a company used for carrying out its operations and projects.

External Reporting

The process of providing information about a company's financial performance to outside parties, such as investors and regulators.

Q37: Which of the following decision-making tools would

Q55: The following information was taken from the

Q66: Which of the following is a pure

Q86: Collossal Company uses a predetermined rate to

Q94: Which of the following is NOT considered

Q106: The reorder point in the EOQ model

Q140: Unit cost is a critical piece of

Q152: Spoilage in a process costing process means<br>A)

Q168: Figure 3-1 Sonor Systems undertakes its own

Q177: The appropriate cost accounting system to use