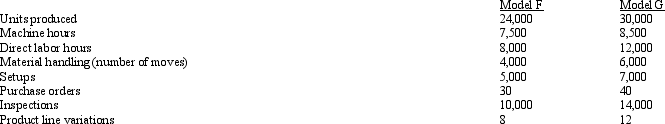

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

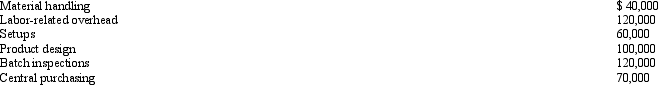

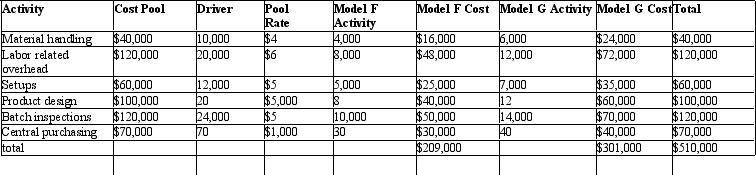

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach using the new rates, what are the overhead costs assigned to Model G in this approximately relevant ABC system?

Definitions:

Personal Selling

A direct, one-on-one form of selling in which a salesperson uses skills and techniques to persuade a buyer to purchase a product or service.

Time

The ongoing sequence of events and the resource that can be managed, spent, saved, or wasted in activities or processes.

Extended Credit

A financial arrangement that allows a customer to purchase goods or services on account, paying for them at a later date.

Collection System

A process or network designed for gathering and transporting something, often used in the context of waste collection or receivables in finance.

Q6: Figure 3-1 Sonor Systems undertakes its own

Q6: Iron Horses Corporation produces two types of

Q49: Unit-level cost drivers create distortions when<br>A) different

Q87: What is the most important factor that

Q99: The costs incurred for the acquisition of

Q121: Selected account balances of Samaritan Company for

Q133: Lavender Company has decided to use a

Q146: The production level the firm expects to

Q152: If unit-based product costing is used, which

Q187: Unit based costing first assigns overhead costs