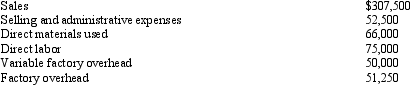

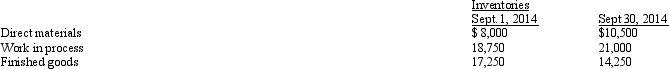

Figure 2-12 Information from the records of the Conundrum Company for September 2014 was as follows:

Conundrum Corporation produced 20,000 units.

Conundrum Corporation produced 20,000 units.

Refer to Figure 2-12. If production increased to 32,000 units next year, what is the effect on variable product costs per unit and total product costs per unit respectively?

Definitions:

Portfolio Expected Return

The weighted average of the expected returns on the assets contained within a portfolio.

Portfolio Risk

Portfolio Risk refers to the potential for loss in an investment portfolio, arising from the variability of returns from the various assets held within the portfolio.

Index Funds

Investment funds that replicate the performance of a specific index of stocks, bonds, or other financial assets.

Expected Opportunity Losses

The anticipated amount of loss associated with not choosing the optimal course of action in decision-making under uncertainty.

Q18: A corporation with taxable income of $400,000

Q21: Answer the following questions pertaining to just-in-time

Q29: In an accounting information system, the inputs

Q63: A linear programming model would NOT include

Q70: Which of the following costs is NOT

Q89: Concierge Industries manufactures 40,000 components per year.

Q100: A traditional cost accounting system assumes that

Q101: If inventory consists of goods produced internally,

Q105: The contribution margin variance is the difference

Q108: Figure 17-1 The following data pertains to