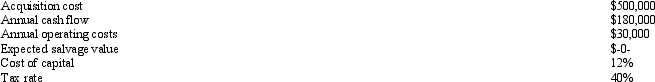

Vendome Company is considering the purchase of the following computer equipment, which is considered 5-year property for tax purposes:  Vendome plans to use MACRS and keep the production equipment for seven years. (Round amounts to dollars.)

Vendome plans to use MACRS and keep the production equipment for seven years. (Round amounts to dollars.)

The tax savings from depreciation in Year 3 would be

Definitions:

Amortization of Bond Discount

The gradual reduction of a bond discount over the life of the bond, transferring it from the balance sheet to interest expense on the income statement.

Semiannual Interest

Interest that is calculated and paid twice a year on investments or loans.

Straight-line Method

A method of allocating an asset's cost evenly across its useful life.

Installment Note Payable

A debt or loan that is to be returned to the lender in regular periodic payments.

Q4: The following information pertains to Steel Wheels,

Q6: Lean manufacturing adds value by reducing labor

Q8: A marker or card that specifies the

Q57: Which of the following equations determines the

Q79: One limitation to profitability analysis is its

Q97: Which of the following is an example

Q103: Classify the following costs incurred by a

Q113: Sweet Tooth Company manufactures candy. The company

Q122: Lorillard Corporation has the following information for

Q144: Assume the following data for Rodriguez Services,