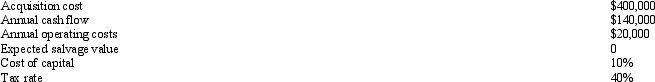

Colorform Company is considering the purchase of the following computer equipment, which is considered 5-year property for tax purposes:  Colorform Company plans to use MACRS and keep the production equipment for seven years. (Round amounts to dollars.)

Colorform Company plans to use MACRS and keep the production equipment for seven years. (Round amounts to dollars.)

Tax savings from depreciation in Year 3 would be

Definitions:

Machine-Hours

A metric for attributing indirect costs to products, calculated by counting the time production machinery is operated.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products, based on estimated overhead costs and estimated activity levels, computed at the beginning of an accounting period.

Manufacturing Cost

The total expense incurred in the process of producing goods, including direct materials, direct labor, and overhead costs.

Direct Labor Cost

The expense associated with labor directly involved in the production of goods or services, excluding indirect labor costs.

Q12: Figure 17-1 The following data pertains to

Q52: In an independent project, the required rate

Q71: Value-chain product costs include which of the

Q84: Cellestial Manufacturing Company produces Products A1, B2,

Q85: Maldovar Company is considering purchasing a new

Q95: Which of the following would NOT be

Q103: A decision to accept or reject a

Q129: The overall objective of accounting information is

Q140: An example of a tangible product, rather

Q168: The system that focuses on the management