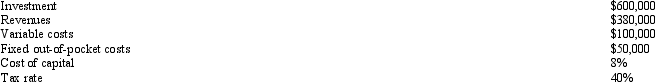

Information about a project Wunderbar Company is considering is as follows:  The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Perfect Competition

A market structure characterized by a large number of small firms producing identical products, with no single firm able to influence the market price.

Marginal Unit

The additional unit of output or product considered in decision-making, analyzing the benefits of producing one additional unit.

Price

Price signifies the amount of money expected, required, or given in payment for something, acting as the mediator of the supply and demand in a market.

Ethanol Subsidies

Financial incentives provided by governments to support the production and use of ethanol as a form of alternative energy, usually to promote environmental benefits or energy independence.

Q5: Figure 3-6 The Stanford Company incurred the

Q41: Projects that, if accepted preclude the acceptance

Q47: Which of the following methods consider the

Q48: Which of the following equations is CORRECT?<br>A)

Q53: In a cost-volume-profit graph, the slope of

Q78: Which of the following capital investment models

Q79: Under the current tax law, an asset

Q100: What are the differences that affect capital

Q137: Profits are measured to determine the viability

Q191: Figure 3-7 The following computer printout estimated