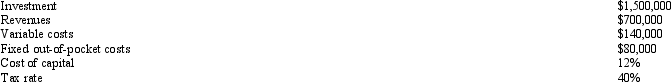

Information about a project Dalwhinnie Company is considering is as follows:  The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year. No salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The property is considered 5-year property for tax purposes. The company plans to use MACRS and dispose of the property at the end of the sixth year. No salvage value is expected. Assume all cash flows occur at the end of the year. Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

Definitions:

Q14: Profit-linked productivity measurement involves the measuring of

Q37: What is the primary difference between variable

Q47: Yankton Industries manufactures 20,000 components per year.

Q63: Missoula Office Services is considering the purchase

Q70: The following data is available of

Q85: Apparent Corp. has developed the following information

Q113: Sweet Tooth Company manufactures candy. The company

Q122: Which of the following is NOT an

Q129: Lean manufacturing benefits of better quality, reduced

Q134: When the market share variance is unfavorable,