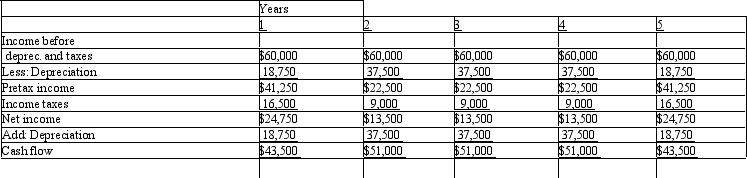

Bertram Corporation is considering an investment in equipment for $150,000.

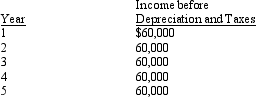

Data related to the investment are as follows:

Cost of capital is 10 percent.

Cost of capital is 10 percent.

Bertram uses the straight-line method of depreciation with mid-year convention for tax purposes. In addition, its tax rate is 40 percent and the depreciable life of the equipment is four years with no salvage value. The equipment is sold at the end of the fifth year.

Required:

Determine the following amounts using after-tax cash flows:

Definitions:

Hypothalamus

Important autonomic and neuroendocrine control center beneath the thalamus.

Oxytocin

A hormone and neurotransmitter involved in childbirth and lactation, as well as in fostering social bonds and behaviors, such as trust and empathy.

APGAR Score

A quick test performed on a newborn at 1 and 5 minutes after birth, measuring five criteria to evaluate the baby's physical condition and determine any immediate need for extra medical or emergency care.

Umbilical Vein

A vein in the umbilical cord that carries oxygenated blood from the placenta to the fetus.

Q26: The activity resource usage model focuses on

Q82: The Johnson Company is trying to find

Q94: Consolidated Corporation had the following information: <img

Q95: Yankton Industries manufactures 20,000 components per year.

Q114: The accounting rate of return on original

Q116: Taylor Company's budgeted sales were 10,000 units

Q123: A subsystem of the accounting information system

Q156: The _ is used by the lean

Q164: Profit-related variances focus on the difference between

Q185: Product costs are converted from cost to