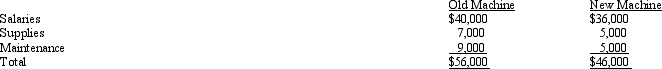

Marion Dexter Company is evaluating a proposal to purchase a new machine that would cost $100,000 and have a salvage value of $10,000 in four years. It would provide annual operating cash savings of $10,000, as follows:

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in one year the old machine will require repairs predicted to cost $35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in one year the old machine will require repairs predicted to cost $35,000.

Marion Dexter's cost of capital is 14 percent.

Required:

Should the new machine be purchased? Why or why not?

Definitions:

Parent Entity

A company that holds a controlling interest in another company or companies, usually through majority ownership of shares.

Intragroup Transaction

Intragroup transactions refer to transactions between entities within the same group, such as sales, services, or financing activities, which are usually eliminated in consolidated financial statements.

Realised Profit

Profit that has been actually earned and received, typically from the sale of goods, services, or assets.

External Party

An entity or individual that is outside of an organization and can include suppliers, customers, government agencies, and lenders.

Q40: Bellamy Company is considering the purchase of

Q98: the manufacturing model which shares the same

Q98: Which of the following is NOT an

Q101: The product life cycle describes the profit

Q103: If the net present value is positive,

Q105: A keep-or-drop decision uses irrelevant cost analysis

Q125: The Kanban system is used to<br>A) ensure

Q131: Figure 15-2 The following information relates to

Q140: The Levinson Company expected to produce 23,000

Q189: Cost is the cash or cash equivalent