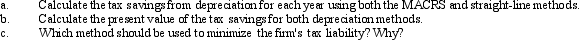

Local Construction Company is considering the purchase of a bulldozer for $280,000. The expected life is four years. The company is comparing the depreciation tax shield using MACRS versus the straight-line method. If MACRS is used, the MACRS life is three years with a depreciation rate of 200 percent annually. Regardless of the method of depreciation used, the mid-year convention will be observed. The company's tax rate is 40 percent. The straight-line method assumes mid-year convention, and the cost of capital is 14 percent.

Required: (Round all calculations to the nearest dollar.)

Definitions:

Expenses

Costs incurred in the running of a business or the completing of an activity.

Licensing

An agreement where a company allows another entity to produce its goods in exchange for a designated fee.

International Market

A market that encompasses the trading of goods, services, technology, capital, and/or knowledge across national borders.

Trademarks

Legally registered symbols, names, or expressions used exclusively by a company to represent their products or services.

Q1: Figure 20 - 5 The Golden Wheels

Q12: Figure 2-16 A small engine repair shop

Q30: The set of interrelated parts that performs

Q35: Knoxville Manufacturing Company produces X and Y

Q56: When conflicting signals are received from using

Q67: The Furthur Phish Company has recorded the

Q86: The direct costs of operating a college

Q100: The income measurement required for external financial

Q106: Symbiosis Company had the following information: <img

Q191: Figure 3-7 The following computer printout estimated