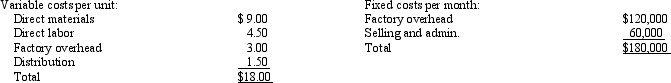

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

Definitions:

Amortized

Gradually reducing a debt through regular payments of both principal and interest.

Compounded Monthly

The process of calculating interest on both the initial principal and the accumulated interest from previous periods on a monthly basis.

Amortized

Refers to the process of gradually reducing debt through regular payments that cover both interest and principal over a set period.

Compounded Monthly

This process involves the reinvestment of interest, so each month's interest earning is based on the principal plus the previously earned interest.

Q44: Assuming all other things are the same,

Q78: Cain Company and Abel Corporation have the

Q85: If costs of quality were evaluated accurately,

Q91: If beginning work-in-process inventory is $160,000, ending

Q95: Which of the following would NOT be

Q113: An irrelevant cost is one that is

Q125: The following information pertains to James Adams

Q130: In a cost-volume-profit graph, the slope of

Q154: Explain the difference between technical and input

Q175: If management is reviewing a multiple-period trend