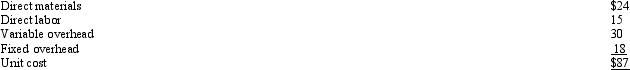

The following information relates to a product produced by Malkovich Company:  Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

If the firm produces the special order, the effect on income would be a

Definitions:

Forward Rate

An agreed-upon interest rate for a financial transaction that will occur in the future, used in forward contracts and rate agreements.

Zero-coupon Bond

A bond that does not pay periodic interest and is sold at a discount from face value; its return comes from the difference between the purchase price and the face value paid at maturity.

Yield

The income return on an investment, such as the interest or dividends received, usually expressed as an annual percentage based on the investment's cost, its current market value, or its face value.

Zero-coupon Bond

A debt security that does not pay interest (coupon) but is traded at a deep discount, providing profit at maturity when the bond is redeemed for its face value.

Q16: On a profit-volume graph, the intersection of

Q70: Lean manufacturing is concerned with eliminating waste

Q78: Which of the following capital investment models

Q90: Figure 16 - 1 The Cumberland Company

Q94: Consolidated Corporation had the following information: <img

Q99: Assume the following information: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2044/.jpg" alt="Assume

Q101: The assessment of productive efficiency for all

Q142: An alternative to the limitation of focusing

Q154: Explain the difference between technical and input

Q159: Another term for predatory pricing in the