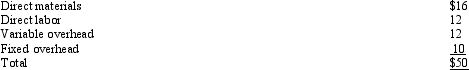

Senior Company currently buys 35,000 units of a part used to manufacture its product at $40 per unit. Recently the supplier informed Senior Company that a 20 percent increase will take effect next year. Senior has some additional space and could produce the units for the following per-unit costs (based on 35,000 units):

If the units are purchased from the supplier, $200,000 of fixed costs will continue to be incurred. In addition, the plant can be rented out for $20,000 per year if the parts are purchased externally.

If the units are purchased from the supplier, $200,000 of fixed costs will continue to be incurred. In addition, the plant can be rented out for $20,000 per year if the parts are purchased externally.

Required:

Should Senior Company buy the part externally or make it internally?

Definitions:

Marginal Tax Rate

The tax rate paid on the next dollar earned.

Average Tax Rate

Total amount of tax paid divided by total income.

Total Taxes

The aggregate amount of taxes collected by a government from individuals and businesses.

Taxable Income

The portion of an individual or entity's income that is subject to taxation, after deductions and exemptions, according to the law.

Q23: Assume the following cost behavior data for

Q25: Which of the following is NOT an

Q28: A profit-volume graph<br>A) measures profit or loss

Q86: The present value of $10,000 to be

Q106: Chinchilla Company is considering the purchase of

Q113: Biscuit Company sells its product for $50.

Q116: Breadline Corporation has the following information for

Q119: The operations of Smithsonian Corporation are divided

Q125: The difference between the total profit change

Q134: When the market share variance is unfavorable,