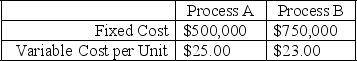

A company is evaluating which of two alternatives should be used to produce a product that will sell for $35.00 per unit.The following cost information describes the two alternatives

The break-even volume for Process A is

Definitions:

Discounted Payback

This refers to the period of time it takes to recoup an investment in terms of its discounted cash flows, taking the time value of money into account.

Payback

The period it takes for an investment to generate an amount of income or cash equivalent to the cost of the investment.

Internal Rate Of Return

A metric used in financial analysis to estimate the profitability of potential investments, representing the discount rate that makes the net present value of all cash flows equal to zero.

Initial Cost

Initial cost refers to the expense incurred to purchase an asset or start a project, including the acquisition price and any additional costs necessary to bring the asset to a usable state.

Q5: Which of the following will not improve

Q27: Acceptance sampling involves the inspection of a

Q36: A phantom bill of material is appropriate

Q37: The design process begins with understanding the

Q40: The process of assigning work to limited

Q44: A hot dog vendor must decide on

Q46: Batch production is also known as a

Q52: The smoothing constant,α,in the exponential smoothing forecast<br>A)must

Q62: Problems associated with using a part-time workers

Q98: Which of the following is NOT a