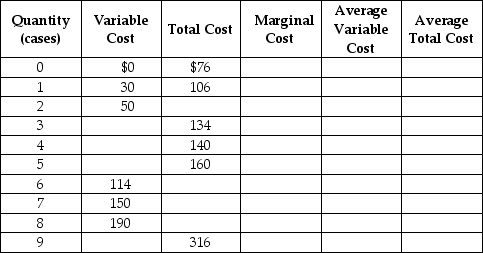

Werner & Sons is a manufacturer of three-ring binders operating in a perfectly competitive industry.Table 7-4 shows the firm's cost schedule.

Table 7-4

Use the table to answer the following questions.

Use the table to answer the following questions.

a.Complete Table 7-4 by filling in the blank cells.

b.Werner is selling in a perfectly competitive market at a price of $40.What is the profit-maximising or loss-minimising output?

c.Calculate the firm's profit or loss.

d.Should the firm continue to produce in the short run? Explain.

e.If the firm's fixed costs were $30 higher,what would be the profit-maximising output level in the short run? Indicate whether the output level will increase,decrease or remain unchanged compared to your answer in b.

f.Suppose fixed cost remains at $76.If the price of three-ring binders falls to $20 what is the profit-maximising or loss-minimising output?

g.Calculate the profit or loss.Should the firm continue to produce in the short run? Explain your answer.

h.Suppose the fixed cost remains at $76.What price corresponds to the shutdown point?

i.Suppose the fixed cost remains at $76.What price corresponds to the break-even point?

Definitions:

Estimated Returns Inventory

Inventory that accounts for goods that are expected to be returned by customers, impacting the valuation of total inventory and cost of goods sold.

Multiple-Step Income Statement

This financial statement format separates operating from non-operating activities, providing a detailed breakdown of revenues, expenses, and net income.

Income from Operations

The profit generated from a company's regular business operations, excluding any extraordinary items.

Estimated Returns Inventory

Inventory that is reserved or set aside by a company, based on historical data, to account for future product returns from customers.

Q58: Refer to Figure 8-13.If the regulators of

Q60: Explain how the listed events (a-d)would affect

Q74: Refer to Table 5-4.Suppose that the quantity

Q94: Refer to Table 5-4.If a minimum wage

Q106: If a monopolist's price is $50 at

Q119: To maximise profit,a firm will produce the

Q127: Refer to Figure 5-1.If the market price

Q196: If the marginal cost curve is below

Q230: When the government makes a firm the

Q244: Market power refers to<br>A) the ability of