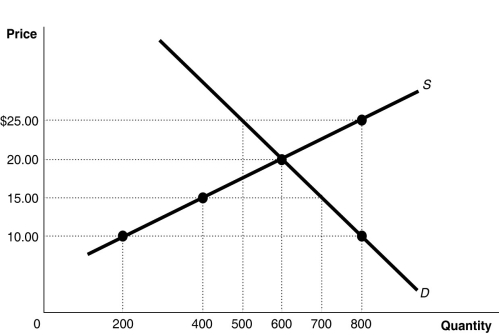

Figure 3-4

-Refer to Figure 3-4.If the price is $10,

Definitions:

Excise Tax

A type of indirect tax imposed on specific goods, such as tobacco and alcohol, often with the aim of reducing their consumption or generating revenue.

Public Golf Courses

Golf facilities that are owned by a government entity and are open to the public, typically requiring payment of a fee for use.

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, leading to a higher burden on lower-income individuals.

High-Income

A category used to describe individuals or households that earn significantly more money than the average for their area or country.

Q5: Technological advancements have led to lower prices

Q26: If,in a competitive market,marginal benefit is less

Q32: The minimum wage is an example of

Q38: Bella can produce either a combination of

Q50: As the number of firms in a

Q70: A tariff is a tax imposed by

Q96: Which of the following are positive economic

Q135: Suppose that to increase sales of hybrid

Q138: Refer to Figure 5-1.Arnold's marginal benefit from

Q161: What is a black market?