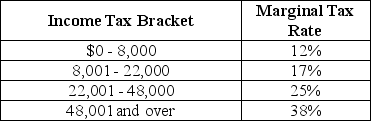

Table 18-4

Table 18-4 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-4.Sasha is a single taxpayer with an income of $60,000.What is his marginal tax rate and what is his average tax rate?

Definitions:

Count Function

A feature or formula in spreadsheet and database software used to tally the number of entries in a particular dataset or criteria.

Counta Function

A feature in spreadsheet applications that tallies the quantity of non-empty cells within a specified range.

Min Function

A programming function that determines the smallest value among its arguments or elements in a data set.

Status Bar

A user interface element typically found at the bottom of an application window, displaying information about the current state of the application or selected objects within it.

Q12: The labor supply for an industry would

Q38: Which of the following is likely to

Q57: If a natural monopoly regulatory commission sets

Q57: Assuming zero transaction cost,if your local grocer

Q61: In 2011,Netflix was charging $23.98 per month

Q65: Which of the following will not cause

Q88: Increases in real GDP would overstate the

Q103: Refer to Figure 15-9.What is the economically

Q121: The Center for Science in the Public

Q126: In the circular flow model,households supply resources